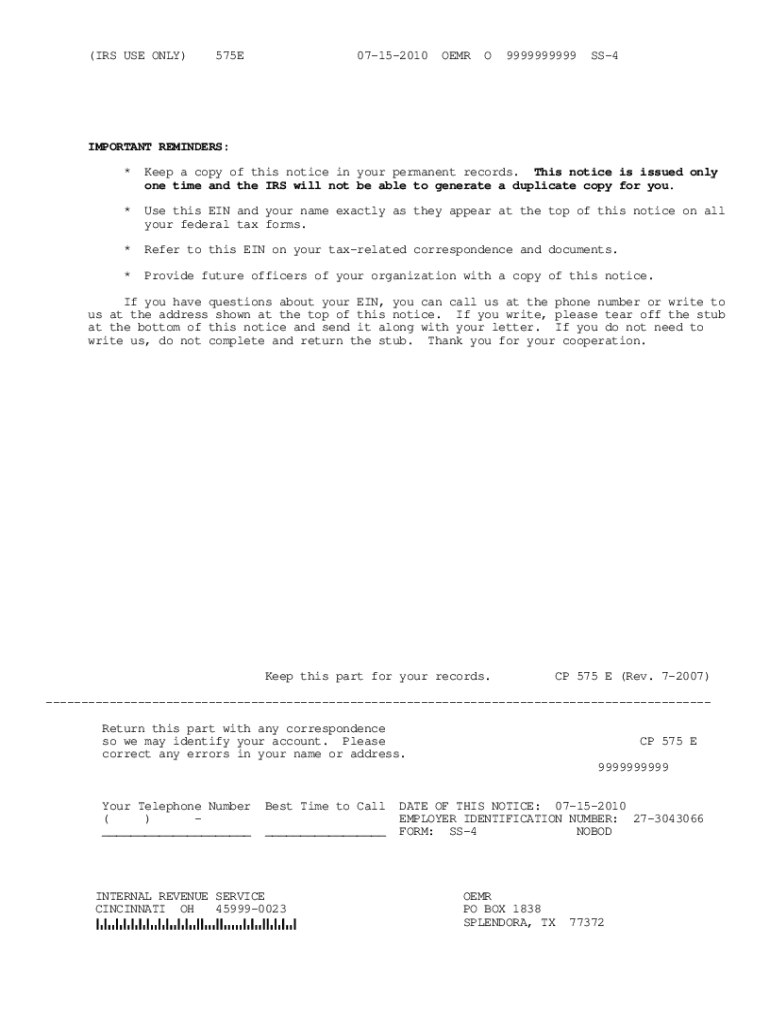

Cp 575 Form

What makes the form 575 legally valid?

Finding documents is not the difficult portion when it comes to browser document management; making them legal is.

The first task is to look at the actual relevance of your form you plan using. Official inctitutions can't take out-of-date forms, so it's essential to use only forms that are current and up to date.

Next, ensure you provide all the necessary information. Examine required areas, the list of attachments, and extra documents very carefully. File all of the documents in one package to avoid misconceptions and speed up the procedure of handling your documents.

Additionally, observe the submitting approaches needed. Find out if you're allowed to send documents via internet, and in case you are, think about using secure platforms to complete the cp 575, eSign, and send.

How you can protect your cp 575 form pdf when completing it online

In case the institution the cp 575 form download will be delivered to permits you to do it via internet, implement safe document administration by using the guidelines listed below:

- Find a safe platform. Look at airSlate SignNow. We store data encrypted on reliable servers.

- Examine the platform's compliance. Read more about a service's acceptance in other countries. For instance, airSlate SignNow electronic signatures are accepted in the majority of countries.

- Pay attention to the software and hardware. Encoded connections and safe servers mean absolutely nothing if you have malicious software on your computer or make use of public Wi-Fi.

- Add more security levels. Turn on two-factor authentications and create password-protected folders to guard sensitive data.

- Count on possible hacking from anywhere. Keep in mind that fraudsters can mask behind your relatives and colleagues, or companies. Check documents and hyperlinks you receive via email or in messengers.

Quick guide on how to complete irs form cp 575 pdf

airSlate SignNow's web-based service is specially made to simplify the organization of workflow and enhance the whole process of qualified document management. Use this step-by-step instruction to complete the Ir's form cp 575 pdf promptly and with idEval precision.

How to fill out the Ir's form cp 575 pdf online:

- To begin the form, utilize the Fill camp; Sign Online button or tick the preview image of the form.

- The advanced tools of the editor will direct you through the editable PDF template.

- Enter your official contact and identification details.

- Use a check mark to indicate the answer wherever necessary.

- Double check all the fillable fields to ensure total accuracy.

- Utilize the Sign Tool to create and add your electronic signature to airSlate SignNow the Irs form cp 575 pdf.

- Press Done after you fill out the document.

- Now it is possible to print, download, or share the form.

- Refer to the Support section or get in touch with our Support staff in the event you have any concerns.

By utilizing airSlate SignNow's complete service, you're able to execute any needed edits to Ir's form cp 575 pdf, create your personalized digital signature in a couple fast actions, and streamline your workflow without the need of leaving your browser.

Create this form in 5 minutes or less

Video instructions and help with filling out and completing Cp 575 Form

Instructions and help about what is cp 575 form

FAQs cp575

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

-

What is the best way to fill out a PDF form?

If you are a user of Mac, iPhone or iPad, your tasks will be quickly and easily solved with the help of PDF Expert. Thanks to a simple and intuitive design, you don't have to dig into settings and endless options. PDF Expert also allows you to view, edit, reduce, merge, extract, annotate important parts of documents in a click. You have a special opportunity to try it on your Mac for free!

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

Related searches to cp575 form

Create this form in 5 minutes!

How to create an eSignature for the irs form cp575

How to make an eSignature for your Ir's Form Cp 575 Pdf online

How to create an electronic signature for the Ir's Form Cp 575 Pdf in Chrome

How to generate an eSignature for putting it on the Ir's Form Cp 575 Pdf in Gmail

How to make an eSignature for the Ir's Form Cp 575 Pdf straight from your mobile device

How to create an eSignature for the Ir's Form Cp 575 Pdf on iOS

How to generate an electronic signature for the Ir's Form Cp 575 Pdf on Android OS

People also ask cp575 internal revenue form

-

How do I check if my EIN is valid?

To check on the status of your federal tax ID number, contact the IRS by telephone at 800-829-4933. Press the number on your touchstone keypad as directed by the automated recording to have your call directed to \u201cEmployee or Federal Identification Number inquiries.\u201d.

-

What is a CP 575 form?

The IRS Form CP 575 is an Internal Revenue Service (IRS) generated letter you receive from the IRS granting your Employer Identification Number (EIN). A copy of your CP 575 may be required by the Medicare contractor to verify the provider or supplier's legal business name and EIN.

-

What is a CP 575 from the IRS?

The IRS Form CP 575 is an Internal Revenue Service (IRS) generated letter you receive from the IRS granting your Employer Identification Number (EIN). A copy of your CP 575 may be required by the Medicare contractor to verify the provider or supplier's legal business name and EIN.

-

How do I get a copy of my EIN letter?

If you have lost your EIN Verification Letter from the Department of Treasury, you can request a new one. To do so, call the IRS Business & Specialty Tax Line toll-free at 1-800-829-4933 between the hours of 7am and 7pm in your local time zone. Request a 147c letter when you speak with an agent on the phone.

-

How can I get a copy of my EIN confirmation letter?

You can contact the IRS directly at (267) 941-1099 (if you are not in the U.S.) or at 800-829-4933 (if you are in the U.S.) and request a replacement confirmation letter called a 147C letter; the IRS will fax it to you upon request.

Get more for what is a cp 575

Find out other cp 575 a

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors